south carolina inheritance tax 2020

A married couple is exempt from paying estate taxes if they do not have children. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

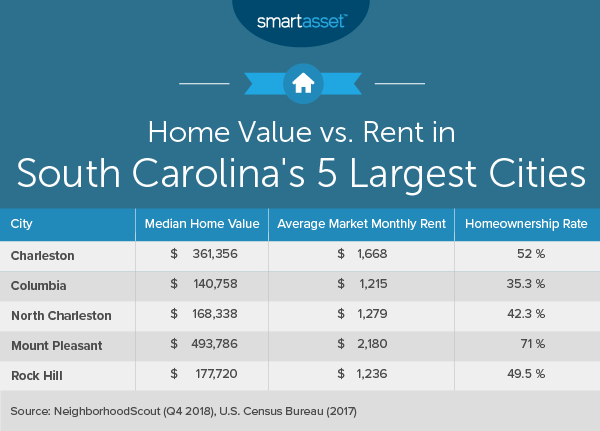

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina does not tax inheritance gains and eliminated its estate tax in 2005.

. Federal exemption for deaths on or after January 1 2023. From Fisher Investments 40 years managing money and helping thousands of families. No estate tax or inheritance tax.

1158 million in 2020 the estate is subject to an estate tax. Info about South Carolina probate courts South Carolina estate taxes South Carolina death tax. Creating a will is oftentimes the first step that South Carolina residents must take in estate planning.

South Carolina Inheritance Tax 2021. States That Have Repealed Their Estate Taxes. As in north carolina south carolina does not tax social security benefits.

In 2020 rates started at 10 percent while the lowest. Does South Carolina Have an Inheritance Tax or Estate Tax. In January 2013 Congress set the estate tax exemption at 5000000.

South carolinians pay an average 601. It can be confusing to sort out the process the taxes and the issues that arise after someones death. It is one of the 38 states that does not have either inheritance or estate tax.

- 2020-09-14 - 2020-09-15 035542 - 12 What. Seven states have repealed their estate taxes since 2010. Still individuals who are gifted more than 15000 in one calendar year are subject to the federal gift tax.

1 Decedent means a deceased person. In 2020 rates started. Federal estate tax The federal estate tax is applied if an inherited estate is more than 1158 million in 2020.

At least But less than If your taxable income is. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. If they are married the spouse may be able to leave everything to each other without paying any. South Carolina Inheritance Law.

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. If your taxable income is. Like estate taxes and inheritance taxes South Carolina also does not have a gift tax.

This site will help. As well as how to collect life insurance pay on death. South carolina inheritance tax and gift tax.

The requirements for a valid will change from state to state but are pretty. South Carolina has no estate tax for decedents dying on or after January 1 2005. Delaware repealed its tax as of January 1 2018.

If you have additional questions about the North Carolina inheritance tax contact an experienced Greensboro probate attorney at The Law Offices of Cheryl David by calling 336. 2020 South Carolina Individual Income Tax Tables Revised 61820 If your taxable income is. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Real Estate Property Tax Data Charleston County Economic Development

A Guide To South Carolina Inheritance Laws

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Top 25 Best Places To Live In South Carolina

A Guide To South Carolina Inheritance Laws

States With No Estate Tax Or Inheritance Tax Plan Where You Die

South Carolina Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

These Are The 10 Best Places To Live In South Carolina

South Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A Guide To South Carolina Inheritance Laws

South Carolina Income Tax Calculator Smartasset

Where S My Refund South Carolina H R Block

Cost Of Living In South Carolina Smartasset

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

17 Things You Must Know Before Moving To South Carolina

Florida Vs South Carolina For Retirement Which Is Better 2020 Aging Greatly