after tax income calculator iowa

This is equal to a percentage of Iowa taxes paid with rates ranging from 0 to 20. If you make 197000 in Iowa what will your salary after tax be.

Iowa Paycheck Calculator Smartasset

You can quickly estimate your Iowa State Tax.

. However an annual monthly weekly and daily breakdown of your tax amounts will be provided in the written breakdown. This Iowa hourly paycheck. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Overview of Wisconsin Taxes. SmartAssets Iowa paycheck calculator shows your hourly and salary income after federal state and local taxes. The taxes that are taken into account in the calculation consist of your.

However an annual monthly weekly and daily breakdown of your tax amounts will be provided in the written breakdown. An additional standard deduction amount is available to Iowa taxpayers who are blind were. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

States collect a state income tax. Your average tax rate is 222 and your marginal tax rate is 361. Our income tax and paycheck calculator can help you understand your take home pay.

To calculate the Iowa Earned Income Tax Credit multiply your federal EITC by 15 15. In addition to federal income tax collected by the United States most individual US. The state income tax rates range from.

The rate ranges from 033 on the low end to 853 on the high end. The state income tax rates range from 0 to 65 and the sales tax rate is 6. After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax.

Youll then get a breakdown of your total tax liability and take-home. Our income tax and paycheck calculator can help you understand your take home pay. Fields notated with are required.

For instance an increase of. Income tax calculator Iowa Find out how much your salary is after tax Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 55000 Federal Income Tax - 5088 State Income Tax - 2396 Social Security - 3410 Medicare - 798 Total tax - 11691 Net pay 43309 Marginal tax rate 349 Average tax rate 213 787 Net pay 213. Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income.

Iowa does not have any local. It can also be used to help fill steps 3 and 4 of a W-4 form. If you make 85000 in Iowa what will your salary after tax be.

The income tax rate ranges from 033 to 853. Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck. Your AMT tax is calculated as 26 of AMTI up to 199900 99950 for married couples filing separately plus 28 of all AMTI over 199900 99950 for married couples filing separately.

So for example if your Iowa tax liability is 1000 and your school district surtax is 15 you would pay an additional 150. After a few seconds you will be provided with a full breakdown of the. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Enter your info to see your take home pay. To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. If you would like to update your Iowa withholding.

Iowa charges a progressive income tax broken down into nine tax brackets. Wisconsin workers are subject to a progressive state income tax system with four tax brackets. Iowa tax law stipulates that your Federal taxes may be deducted from your gross income for.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The taxes that are taken into account in the calculation consist of your.

The state of Iowa requires you to pay taxes if you are a resident or nonresident who receives income from an Iowa source. In this calculation we deduct the Iowa state tax credit of 4000 from your State Taxes Due. The tax rates which range from 354 to 765 are dependent.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Iowa Paycheck Calculator - SmartAsset. Some local governments also impose an income tax often based on state.

How To Pay Your Nanny S Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

5 Form 5 Pdf 5 Things You Won T Miss Out If You Attend 5 Form 5 Pdf

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Is It Better To Buy Or Rent Closing Costs Can Get Expensive And It Can Be Better To Mortgage Refinance Calculator Refinance Mortgage Mortgage Loan Calculator

How To Budget Your Money In 4 Simple Steps Budgeting Budgeting Worksheets Budgeting Finances

Iowa Reduces Corporate Individual Income Tax Rates Grant Thornton

Paying Down Debt How We Paid Off 62 000 In Debt In 7 Months Debt Debt Payoff Plan Pay Debt

How To Calculate Sales Tax For Your Online Store

You May Not Want To Hear How Much Money You Have To Make To Live In Colorado Map Usa Map 30 Year Mortgage

What To Do When The Irs Is After You Irs Personal Finance Lessons Earn More Money

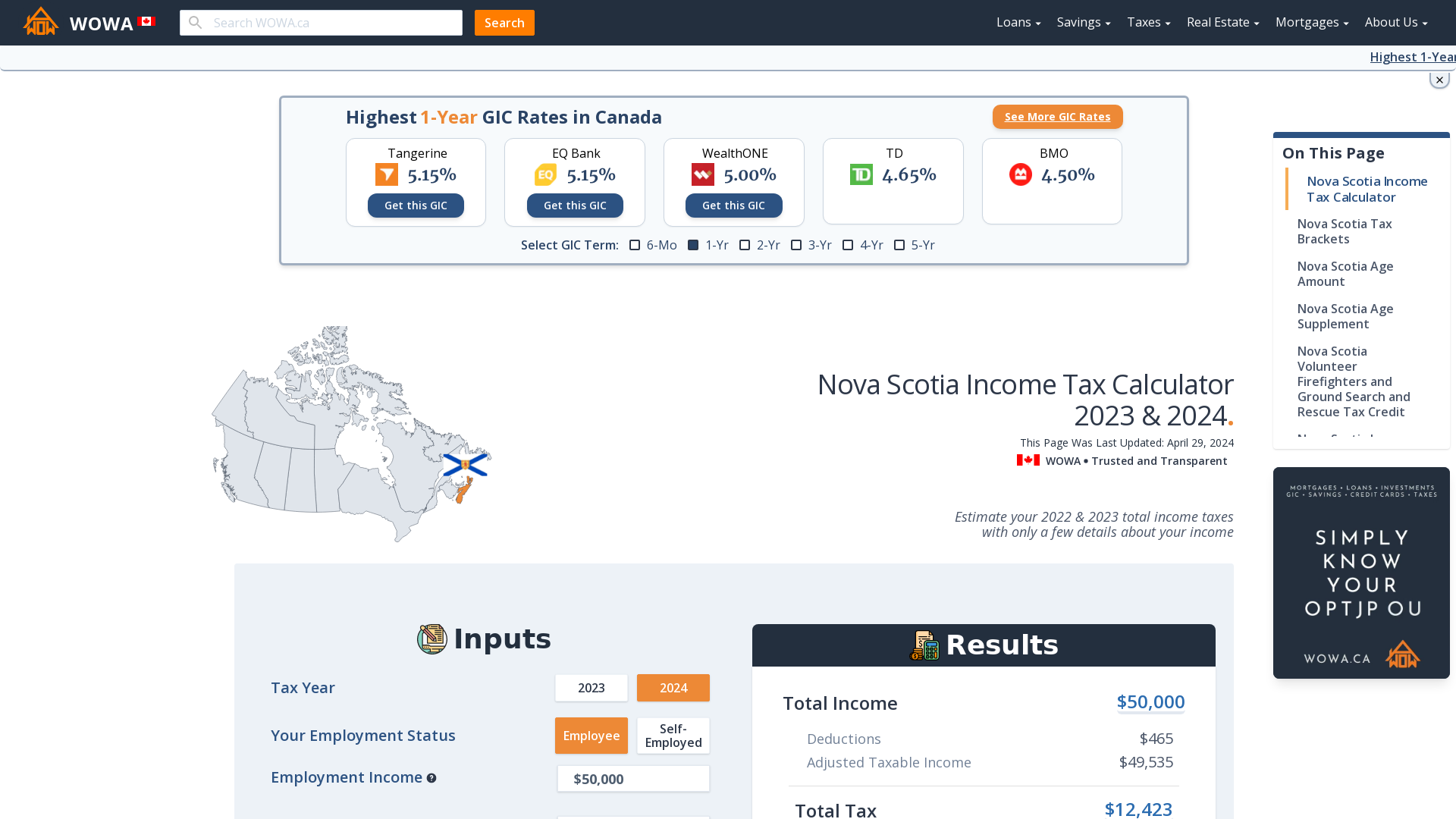

Nova Scotia Income Tax Calculator Wowa Ca

Download Simple Child Support Calculator For Wordpress Free Wordpress Plugin Https Downloadwpfree Com Download S Supportive Child Support Daycare Costs

2015 Irs W9 Form Downloadable Us Gov Forms W9 Free Tax Irs Forms Doctors Note Template Business Letter Format